Iron ore prices and steel: what the last 30 days signal for January

If you deal in steel daily, the iron ore price today is not “just a China number”. It’s one of the earliest upstream signals that feeds into billet price today, and then into tmt price today, sariya ka bhav, rebar price today, and overall steel rate today with a lag.

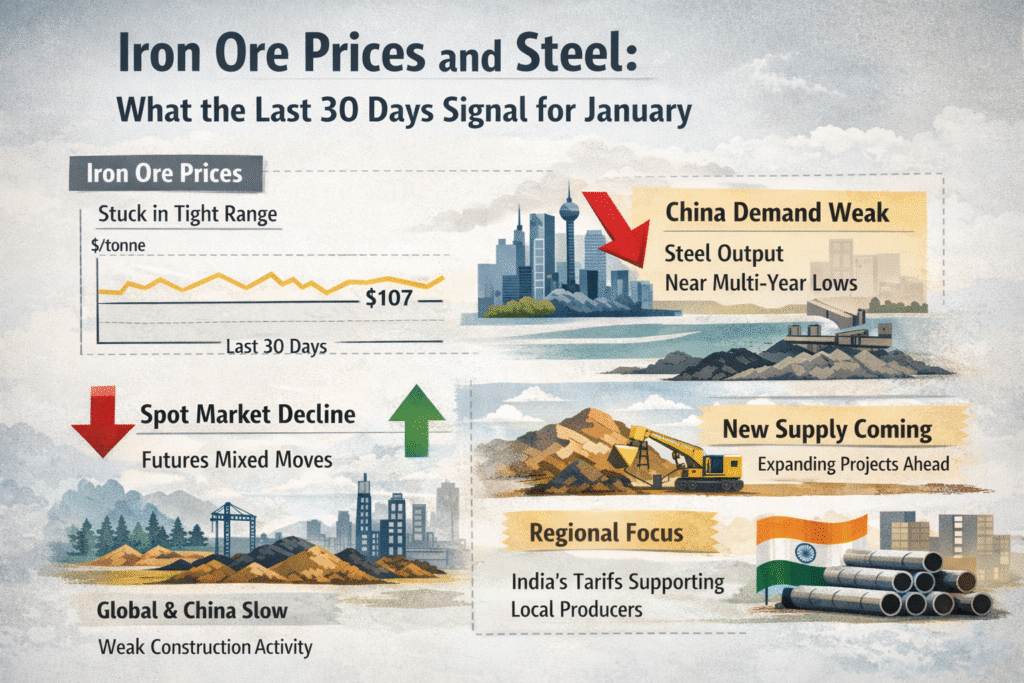

1) Iron ore trend in the last 30 days: firm floor, quick swings

Over the last month, the market has held close to the psychological $100/ton zone for benchmark iron ore 62% CFR China. By end-December, iron ore was quoted around $107/ton (Dec 30, 2025), which tells you the market is not pricing a demand collapse.

At the same time, futures have been whippy. Dalian iron ore contracts moved between weakness (mid-month pressure) and sharp rebounds when macro sentiment improved. What this really means is: the iron ore trend is “range-bound but supported”. That usually translates into steel makers defending finished prices instead of racing each other downward.

2) China demand narrative: property caution, policy hope, and steel output control

China remains the main storyline for iron ore. Headlines have been tugging the market both ways: worries around weak real demand, and optimism when Beijing signals more supportive fiscal posture.

Add a structural layer: China has also reiterated intent to control steel output over 2026–2030 as part of broader policy goals.

For traders, this is the nuance:

- Near-term stimulus talk can lift iron ore prices today because it boosts expectations of construction and infrastructure activity.

- Medium-term, output controls can cap runaway steel production, which can also cap extreme iron ore rallies.

So January is likely to be sentiment-driven: quick spikes on policy optimism, and pullbacks on demand reality.

3) Supply risks: big miners, new supply, and shipment uncertainty

On the supply side, the market is watching producer guidance and new seaborne tonnage. A key recent signal was Vale cutting its iron ore output forecast, citing slower demand and upcoming new supply, including Africa’s Simandou narrative.

This matters because even when demand is mixed, supply-side adjustments can keep the market supported around $95–$110/ton, rather than letting it slide freely.

4) The lag: how ore historically feeds into billets and TMT

In India’s buying cycle, ore doesn’t hit your yard rate instantly. The common path is: iron ore price today → sponge iron / hot metal economics → billet price today → rolling cost → rebar price today / tmt price today.

Academic work on lead-lag relationships also supports the idea that iron ore tends to lead steel product pricing, rather than the other way around.

Practically, the lag is often 2–6 weeks depending on inventory, contracts, and how aggressively mills are rolling.

5) Steel price forecast for January: what to watch every morning

If the last 30 days are the setup, here’s the likely January playbook for a realistic steel price forecast:

- If iron ore holds near ~$100–$110 and China sentiment stays constructive, billet price today tends to remain supported, and sariya ka bhav usually stays firm with limited downside.

- If iron ore drops under $95 with a clear demand shock, billets typically soften after a lag, and then tmt price today corrects.

- Watch these daily SEO-critical markers: iron ore price chart, Dalian iron ore futures, SGX iron ore 62%, billet price today, tmt bar price today, rebar price today in India, and local freight/diesel because delivered rates often move before ex-plant rates.

Bottom line: the last 30 days signal a supported iron ore market, not a breakdown. That usually means January steel pricing stays sticky, and any correction in billets/TMT, if it comes, arrives late, not first week.